Introduction

In 2024, personal debt management remains crucial for financial well-being. With changing economic landscapes, developing practical strategies can ensure stability. Exploring various strategies can offer insights into managing debts effectively.

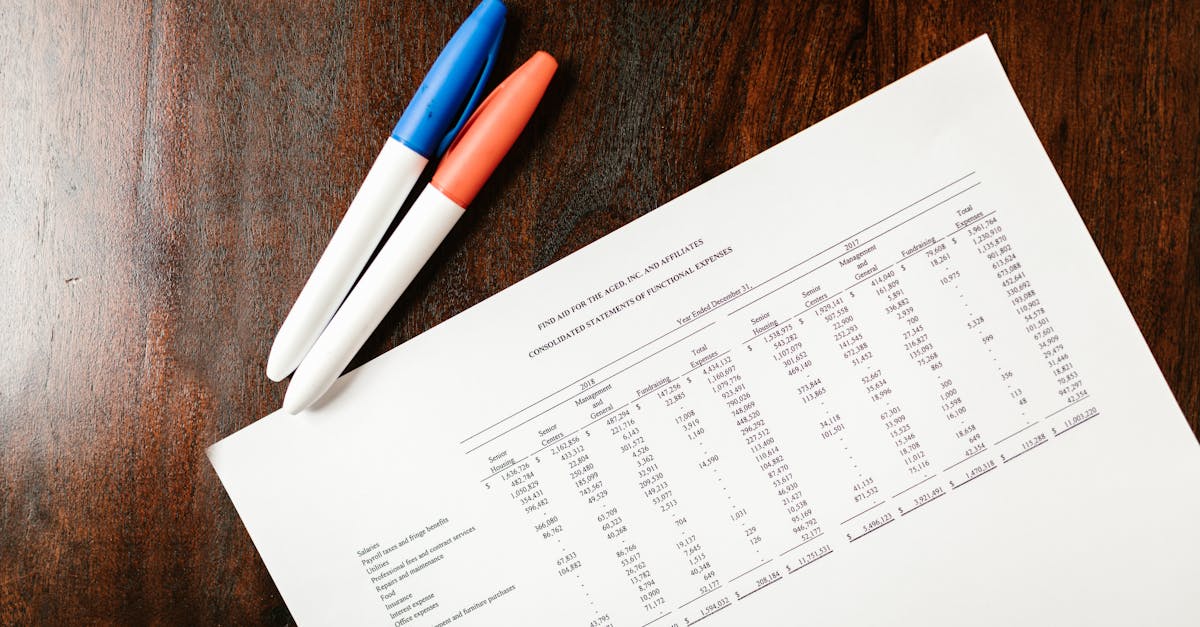

Understanding Your Debt

Begin by categorizing your debts: credit card loans, student loans, and mortgages are common types. Recognizing each debt's interest rate, monthly obligations, and terms can help prioritize repayment. This holistic view lays the groundwork for effective debt management.

Setting a Financial Plan

Developing a budget is paramount. Calculate your monthly income and expenses to determine how much can be allocated towards debt repayment. A balanced plan includes essential living costs while ensuring consistent debt payments. This transparency can help curb impulsive spending.

Prioritizing Debt Repayment

Consider strategies like the avalanche or snowball method. The avalanche focuses on high-interest debts first, minimizing long-term costs, while the snowball builds momentum by tackling the smallest debts. Tailoring a strategy helps maintain motivation and reduce debt efficiently.

Negotiating Better Terms

Don’t hesitate to communicate with creditors. Often, they may offer better terms, such as lower interest rates or extended repayment schedules. This can ease financial strain and contribute to a more manageable repayment process.

Utilizing Balance Transfer and Consolidation Options

Balance transfers or loan consolidations can lower interest rates across multiple debts. By consolidating loans, you streamline payments into one, often reducing monthly burdens. This aids in maintaining consistent payments and decreasing overall debt faster.

Fostering Financial Literacy

Educating oneself about personal finance is indispensable. Understanding how interest accrues and learning investment opportunities can empower better decision-making. Numerous courses and online resources are available to enhance financial literacy effectively.

Avoiding Additional Debt

To manage personal debt effectively, avoid incurring new debts. Utilize cash rather than credit for purchases and resist the temptation of unnecessary expenditures. Keeping disciplined with your spending can protect you from future financial strain.

Exploring Professional Help

Engaging with a financial advisor or credit counseling service can provide personalized guidance. They can offer solutions catered to your situation, potentially identifying aspects you may not have considered, helping you stay on track with your financial goals.

Conclusion

Effectively managing personal debt in 2024 demands strategic planning and informed decision-making. By understanding your debts and fostering financial literacy, achieving long-term stability is possible. Take control today to ensure a secure financial future.